A variety of factors are required to make a career as a clerk in accounting. These factors include the education required, salary, work environment, and other considerations. For a better career as an accounting clerk, you should continue your education. Continue to learn relevant skills by continuing your training. You can advance your career by gaining more experience in the field. Take into account your qualifications to advance in this position. The following tips will help you launch a successful career in accounting clerk.

Job description

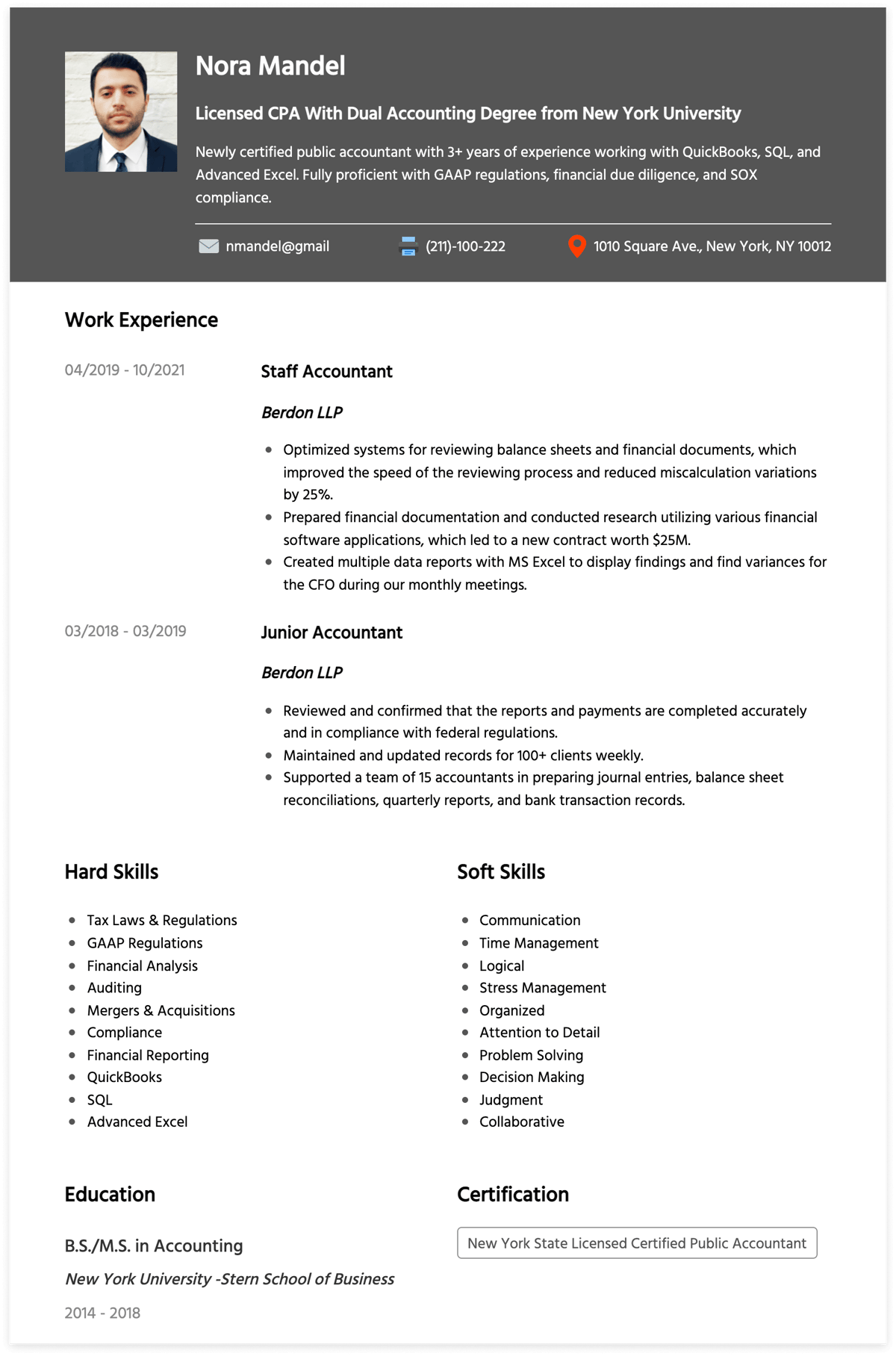

Strong organizational skills are required for a job as an accountant clerk. A daily accounting task will include recording invoices and credit cards deposits, reconciling merchant banks accounts, and running reports on budget. As part of an accounting team, an accounting clerk will also be responsible for data entry and other administrative tasks. The average salary for an American accounting clerk is $38,900. A job description should outline the primary responsibilities and any additional duties that an accounting clerk may be required to perform.

A job description for an accounting clerk should include an introduction paragraph that highlights the company's unique culture and working environment. This is your chance to stand out from the rest and make yourself attractive to prospective job candidates. An accounting clerk must also be able perform routine calculations to verify data figures. Accounting clerks are responsible for maintaining and processing financial records, making copies, reconciling bank accounts, creating financial reports, and entering data into computers. Accounting clerks also have other duties, such as calling customers with delinquent account status.

Education

The Bureau of Labor Statistics projects an increase of 10% in jobs for accounting clerks from 2008 to 2018. Many businesses expanded after the financial crisis. This led to increased transparency in finance. As the US economy develops, so will the demand for accounting professionals. However, there are some improvements in office automation, computer software, and document scanning processes that will decrease the need for accountants. To prepare for the job market, consider pursuing an education in accounting.

You will need an associate's (or bachelor's) degree in accounting to work as an entry-level accountant clerk. Although an associate's degree is sufficient for entry-level positions, many employers prefer those with bachelor's degrees or higher. Some companies may require specific designations. In addition, accounting firms may require you to work in support roles or interns. Furthermore, you can also get practical experience working in a support role or internship for an accounting firm.

Salary

As an accountant clerk, there are many ways you can increase your salary. Although employers are more inclined to hire candidates with post-secondary educations than those without, it is not necessary to hold a college diploma in order for an accounting clerk position. It is important to be proficient in computer programming and math, as well as on-the job training. Based on your experience level, you may need to attend formal classroom training. Accounting clerks should be proficient in both mathematics and computer programming, in addition to their job functions. Burning Glass Technologies predicts that accounting clerks will be in high demand by 2020.

Accounting clerks earn a median salary of $43,000 annually. This average does NOT include bonuses or tips which can add up very quickly. The average total compensation of an accounting clerk can range from $20,500 to $77,000, depending on education, experience and employer. A full-time accounting clerk can earn anywhere from $31,261 to $41,665 per year, which is significantly higher than the average wage for a similar position.

Work environment

Accounting clerks work in a variety of environments. They are responsible to maintain financial records and use computers to analyze financial data. They must be able to use computers effectively and have good communication skills. Here are some tips to help find the right job. Continue reading to find out more about the role and work environment of accounting clerks. This profession is diverse, and you'll be amazed at the opportunities it offers.

A moderate level of social interaction is required of accounting clerks. Many of them are placed in conflict situations with other employees regarding financial matters. They need to be able to manage multiple tasks and meet deadlines. An accounting clerk must also be comfortable in a noisy work environment. Accounting clerks must be able to work quickly and efficiently to ensure the accuracy of financial reports. And as with any job, it's critical that you enjoy working with people.

FAQ

What happens to my bank statement if it is not reconciled?

It's possible that you won't realize it until the end if your bank statement isn't in order.

At this point, you will need repeat the entire process.

What does it mean for accounts to be reconciled?

It involves comparing two sets. One set of numbers is called the source, and the other is called reconciled.

Source consists of actual figures. The reconciled is the figure that should have been used.

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This process ensures that there aren't any errors in the accounting system.

Why Is Accounting Useful for Small Business Owners?

Accounting is not only useful for big businesses. Accounting can also be useful for small businesses because it allows them to track how much money they spend and make.

You likely already know how much money you get each month if your small business is profitable. But what if your accountant doesn't do this for a monthly basis? You might be wondering about your spending habits. You might forget to pay your bills on time which could negatively impact your credit rating.

Accounting software makes keeping track of your finances easy. There are many types of accounting software. Some are free; others cost hundreds or thousands of dollars.

You will need to learn the basic functions of every accounting system. By doing this, you will not waste time learning how to operate it.

These are the three most important tasks you should know:

-

Transcript transactions to the accounting system

-

Keep track of income and expenses.

-

Prepare reports.

These three steps will help you get started with your new accounting system.

What are the main types of bookkeeping system?

There are three main types in bookkeeping: computerized (manual), hybrid (computerized) and hybrid.

Manual bookkeeping uses pen and paper to keep track of records. This method requires attention to every detail.

Software programs are used for computerized bookkeeping to manage finances. It is time- and labor-savings.

Hybrid accounting combines both computerized and manual methods.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to get a Accounting degree

Accounting is the process of keeping track of financial transactions. It can be used to record transactions between individuals and businesses. A bookkeeping record is called an "account". These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types accounting: managerial and general accounting. General accounting deals with reporting and measuring business performance. Management accounting is concerned with measuring, analysing, and managing organizations' resources.

A bachelor's in accounting can prepare students to work as entry-level accountants. Graduates can choose to specialize or study areas such as finance, taxation, management, and auditing.

Accounting is a career that requires a solid understanding of economic concepts like supply and demand and cost-benefit analysis. Marginal utility theory, consumer behavior, price elasticity of demand and law of one price are all important. They need to know about accounting principles, international trade, microeconomics, macroeconomics and the various accounting software programs.

Students interested in pursuing a Master's degree in accounting must have passed at least six semesters of college courses, including Microeconomic Theory; Macroeconomic Theory; International Trade; Business Economics; Financial Management; Auditing Principles & Procedures; Accounting Information Systems; Cost Analysis; Taxation; Managerial Accounting; Human Resource Management; Finance & Banking; Statistics; Mathematics; Computer Applications; and English Language Skills. Students must also pass a Graduate Level Examination. This exam is typically taken after three years of study.

To become certified public accountants, candidates must complete four years of undergraduate studies and four years of postgraduate studies. Candidats must take additional exams to be eligible for registration.