Business success requires a solid understanding of basic accounting concepts. Accounting principles determine the success or failure of a product, service, revenue, tax liability, or any other aspect of a business. Accounting is vital for businesses to make informed decisions and track their progress towards their goals. You need to understand accounting basics and how it works. Read on for more information. Here are some accounting basics.

Account balances increase or decrease depending on account type

Your accounting equation includes two basic types: liability and credit accounts. Debits fall while credit accounts grow in balance. In general, a credit increase is greater than a debit, and vice versa. The chart below shows the various types of accounts and their side effects. Learn more. If you make a payment to your credit account, your credit balance will grow.

Your bank account may have a credit line, so you might see your daily balance rise. Your checking account may show an increasing balance, while your brokerage account might be showing a decreasing balance. Sometimes, your account might even show a negative balance. This could mean that you owe money. This may be due to an error in recording the transaction with the supplier.

Nominal accounts

A business should be familiar with Nominal Accounts. Nominal accounts are accounts that have no physical form but relate to income, expenses, and gains. These accounts are shut down at the close of each accounting period. They start with a zero balance and fluctuate over time based on various expenses and revenues. It is helpful to know the purpose of Nominal Accounts in order to grasp their basic concepts.

Nominal accounts are created with a zero balance at each beginning of the accounting year. They then grow or shrink as transactions are recorded. Sometimes, nominal accounts can be referred to simply as temporary accounts. They are used to track transactions that impact an income statement. They use temporary accounts to track transactions if a company does not have a permanent bank account. How are they different from real accounts?

Cost-benefit principle

Accounting uses the Cost benefit principle to determine the cost of information. It is the idea that information should not have a higher value than its costs. This principle says that corporations should not spend too much time on unnecessary adjustments and give excessive support information in footnotes. This principle should be taken into account when deciding on the components of an accounting system. This principle can be used by companies to decide which information is most relevant and the appropriate level of detail.

The Cost principle is important for verification. Every accounting transaction needs an origin document. The cost of a given asset is recorded on the original sales document. A consistent application in accounting of the Cost-benefit principle will help avoid any changes in the cost over the time and ensure accuracy of financial reports. This principle does have its disadvantages. Some businesses might have valuable logos or brands that are not included in their balance sheets. Therefore, companies may have an undervalued company based on the historical cost of their assets. These companies might have problems getting a loan or selling their business.

Accounting using cash Basis

The Cash Basis of Accounting accounting method is used by businesses. The cash method, unlike accrual accounting that is based only on a period’s expenses, does not reflect customer obligations. This can lead businesses to neglect to record unpaid bills. Cash-based accounting can make it difficult to track valuable assets. This can affect hiring decisions. Accrual accounting is essential for credit companies.

Cash-basis accounting permits companies to keep track of their expenses and only recognize revenue once the project is over. Cash-basis accounting can lead to misleading income statements, as projects can be long-lasting. Businesses should choose this method carefully as it is more accurate and simpler than either GAAP nor IFRS. BYJU'S, an online journal for commerce students, provides useful information on the differences between them.

Bookkeeping with double entries

While most businesses know how to perform double-entry bookkeeping, some don't. This accounting method records both sides in a transaction and depends on two distinct types, credit and debit. Credits can be added to accounts while debits can be taken out of accounts. Each transaction in double-entry bookkeeping must have at least two separate entries. The financial statements of a company should be simple and clear to understand. This type of bookkeeping also makes it easier to spot discrepancies or errors in the numbers.

Double-entry bookkeeping uses trial balances to create financial reports. Profit and Loss statements provide information about revenue and cost breakdown for a certain period. Another important document to be familiar with is the balance sheet. It provides an overview of assets, liabilities, as well as equity. The equity part of the balance sheets reflects profit or losses for both the current and future periods.

FAQ

Why is reconciliation important?

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have serious consequences such as inaccurate financial statements, missed deadlines and overspending.

What does an accountant do? Why is it so important to know what they do?

An accountant keeps track on all the money you make and spend. They also keep track of the tax you pay and any deductions.

An accountant helps manage your finances by keeping track of your income and expenses.

They prepare financial reports for individuals and businesses.

Accountants are needed because they have to know everything about the numbers.

Additionally, accountants assist with tax filing and make sure that taxpayers pay the least amount of tax.

What is Certified Public Accountant?

Certified public accountant (C.P.A.). An accountant with specialized knowledge is one who has been certified as a public accountant (C.P.A.). He/she will assist businesses with making sound business decisions and prepare tax returns.

He/She also keeps track of the company's cash flow and makes sure that the company is running smoothly.

What is bookkeeping and how do you define it?

Bookkeeping is the art of keeping records of financial transactions for individuals, businesses, and organizations. It includes all business expenses and income.

All financial information is tracked by bookkeepers. This includes receipts, bills, invoices and payments. They also prepare tax returns and other reports.

Are accountants paid?

Yes, accountants often get paid hourly.

Some accountants charge extra for preparing complicated financial statements.

Sometimes, accountants are hired for specific tasks. An accountant might be hired by a public relations company to create a report that shows how their client is doing.

What should I look for in an accountant's hiring decision?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You want someone who's done this before and who knows the ropes.

Ask them if they have any special skills or knowledge that would be helpful to you.

Make sure they have a good reputation in the community.

What happens if I don’t reconcile my bank statements?

You may not realize you made a mistake until the end of the month if you don't reconcile your bank statements.

At that point, you'll have to go through the entire process again.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

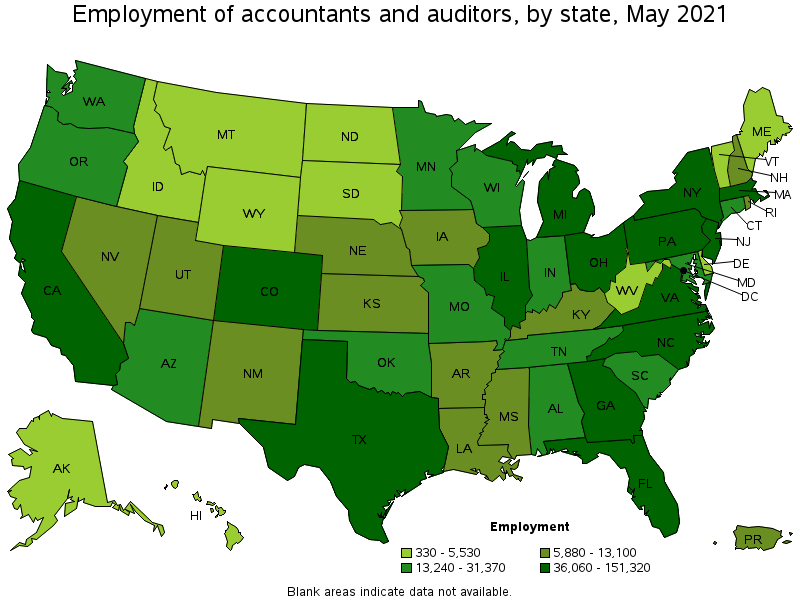

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to Become An Accountant

Accounting is the science and art of recording financial transactions and analyzing them. It also involves the preparation of reports and statements for various purposes.

A Certified Public Accountant (CPA), is someone who has passed a CPA exam and is licensed by the state boards of accounting.

An Accredited Finance Analyst (AFA), an individual who meets certain requirements established by the American Association of Individual Investors. The AAII requires that individuals have at least five years of investment experience before becoming an AFA. They must pass a series of examinations designed to test their knowledge of accounting principles and securities analysis.

A Chartered Professional Accountant (CPA), also known as a chartered accounting, is a professional accountant with a degree from a recognized university. CPAs must adhere to the Institute of Chartered Accountants of England & Wales' (ICAEW), specific educational requirements.

A Certified Management Accountant, also known as a CMA, is a certified professional who specializes on management accounting. CMAs must pass exams administered annually by the ICAEW. They also need to continue continuing education throughout their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs are required to take several tests; one of these tests is known as the Uniform Certification Examination (UCE).

International Society of Cost Estimators' (ISCES) offers the Certified Information Systems Auditor certification. Candidates for the CIA must have completed three levels of education: coursework, practical training, then a final exam.

Accredited Corporate Compliance officer (ACCO) is a distinction granted by the ACCO Foundation, and the International Organization of Securities Commissions. ACOs need to have a bachelor's degree in finance, public policy, or business administration. They must also pass two written exams as well as one oral exam.

A credential issued by the National Association of State Boards of Accountancy is called a Certified Fraud Examiner. Candidates must pass at least three exams to be certified fraud examiners (CFE).

International Federation of Accountants has granted accreditation to a Certified Internal Audior (CIA). Candidates must pass four exams covering topics such as auditing, risk assessment, fraud prevention, ethics, and compliance.

American Academy of Forensic Sciences gives Associate in Forensic Accounting (AFE), a designation. AFEs need to have graduated from an accredited college/university with a bachelor's level in any other field than accounting.

What does an auditor do? Auditors are professionals who audit financial reporting and internal controls of an organization. Audits can be performed on either a random basis or based on complaints received by regulators about the organization's financial statements.