Often, accountant assistants are hired to free up certified accountants to focus on more complex accounting duties. They also process checks, invoices and verify the accuracy of documents.

Accounting assistants have a lot of experience using technology to complete their jobs. They are also skilled in many aspects of finance and accounting. Accountant assistants often work in an office setting under the supervision of a head accountant. They might also be responsible for completing financial reports in tight time frames.

In addition to performing accounting tasks, accountant assistants are also responsible for office administration. A customer assistant is responsible for assisting customers, maintaining files and leadinggers and verifying the accuracy. Large corporations often employ accountant assistants. These companies find accountant assistants especially useful during times of high business volumes. They can also help a company improve their business operations by freeing up certified accountants to handle more complicated tasks.

Accountant assistants typically work for specialized accounting companies. These firms may not offer a diverse work environment. These firms may not offer stable jobs. Accounting assistants can still grow their careers with the company.

Vocational courses are required for accountant assistants to learn basic financial calculations. They are also trained to use popular financial software. You can improve your career as an accountant assistant by taking courses in finance at the tertiary levels. Internships are a great way to get experience as an accountant assistant.

An accountant assistant can work in many settings. This includes the financial department of larger companies as well as smaller ones. Accounting assistants can also be hired to support a single accountant at a small firm. Accountant assistants will learn more about accounting and financial operation when they work in a smaller business. They may be able to contact clients directly through a smaller company. Accounting assistants need to feel comfortable doing this type of work. They should also be willing and able to work long hours.

Accountant assistants can be required to take a numeracy assessment. The applicant for this job may be asked to describe their past work experience in the accounting department. Accounting assistants might also be asked why they are interested. In addition, accountant assistants should explain their career goals. They must also be able to demonstrate proficiency in Sage software and common programs.

Accountant assistants should be able to explain why they would be a good fit for the company. They should also be willing and able to share their thoughts and experiences. Lastly, accountant assistants should be able to demonstrate their enthusiasm for the job. Assistants in accounting must be able to work on their own.

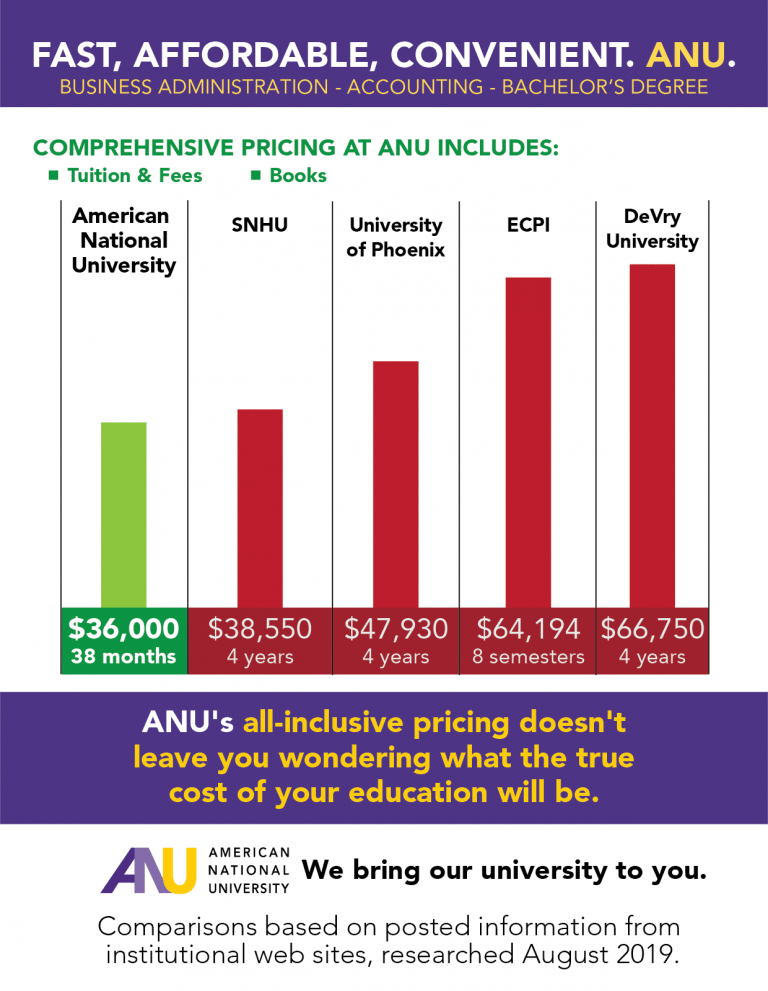

Accounting assistants generally earn a degree in business. Online degrees can also be obtained. The average time to earn a bachelor's degree is four years. Accounting assistants interested in furthering their education can pursue a Master's Degree. Accountant assistants can also obtain Certified Professional Accountant certification (CPA).

FAQ

What is an auditor?

Auditors look for inconsistencies in financial statements and actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also validates the validity and reliability of the company's financial statements.

Accounting is useful for small business owners.

Accounting isn’t only for big businesses. Accounting can also be useful for small businesses because it allows them to track how much money they spend and make.

If you run a small business, you likely know how much money comes in each month. What if you don’t have an accountant to do this for you? You may be wondering where your money is being spent. It is possible to forget to pay your bills on a timely basis, which can negatively affect your credit rating.

Accounting software makes it simple to track your finances. There are many types of accounting software. Some are free while others cost hundreds to thousands of dollars.

But whatever type of accounting system you use, you'll want to understand its basic functions first. So you don't waste your time trying to figure out how to use it.

You should learn how to do these three basics tasks:

-

Transcript transactions to the accounting system

-

Keep track of incomes and expenses.

-

Prepare reports.

Once you have these three skills, you are ready to begin using your new accounting program.

Why is reconciliation important?

It is vital because mistakes can happen at any time. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can lead to serious consequences like inaccurate financial statements and missed deadlines, excessive spending, bankruptcy, and other negative effects.

How long does it take to become an accountant?

To become an accountant, one needs to pass the CPA exam. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the exam, one must be an associate for at most 3 years in order to become a certified public accounting (CPA) after passing it.

What should you expect when you hire an accountant?

When hiring an accountant, ask questions about their experience, qualifications, and references.

You want someone who's done this before and who knows the ropes.

Ask them if they have any knowledge or skills that might be useful to you.

Look for people who are trustworthy in your community.

What is the difference in Chartered Accountant and a CPA?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. A chartered accountant is usually more experienced than a CPA.

Chartered accountants can also offer advice on tax matters.

The average time to complete a chartered accountancy program is 6-8 years.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to get a Accounting degree

Accounting is the process of keeping track of financial transactions. It can be used to record transactions between individuals and businesses. Bookkeeping records are also included under the term "account". Accounting professionals create reports based upon these data in order to assist companies and organizations with making decisions.

There are two types accounting: managerial and general accounting. General accounting focuses on the reporting and measurement of business performance. Management accounting is concerned with measuring, analysing, and managing organizations' resources.

A bachelor's degree in accounting prepares students to work as entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

Accounting is a career that requires a solid understanding of economic concepts like supply and demand and cost-benefit analysis. Marginal utility theory, consumer behavior, price elasticity of demand and law of one price are all important. They should be able to comprehend macroeconomics, microeconomics as well as accounting principles.

A Master's Degree in Accounting is only available to students who have completed at least six semesters in college courses in Microeconomic Theory, Macroeconomic Theory, International Trade; Business Economics; Finance Principles & Procedures. Cost Analysis; Taxation; Human Resource Management; Finance & Banking. Statistics; Mathematics; Computer Applications. English Language Skills. Graduate Level Examination is also required. This examination is usually taken after the completion of three years of study.

Candidats must complete four years' worth of undergraduate study and four years' worth of postgraduate work in order to be certified public accountants. Candidats must take additional exams to be eligible for registration.