A career as an accountant has many benefits. The BLS reports that the average annual salary for accountants at $45,560 is, although some roles can pay more. You should however consider your education requirements if you are interested to pursue this career. In addition to that, continuing your education will help you qualify for higher-level positions and increase your salary. These are some tips that will help you succeed in the field.

Job outlook

Accounting careers are highly sought after, according to the United States Bureau of Labor Statistics. They predict a 6 per cent increase in job openings between 2018-2028. Because accountants are responsible for maintaining and analyzing financial records, there is a high demand for these professionals in many other sectors. MoneyWise reports that accountant and auditor positions are among America's 15 fastest-growing occupations. Over the next seven decades, more than 139,000 auditor and accountant positions will be created.

CAs are more educated and trained than CPAs and can also work for foreign companies. Although CA jobs don't come as often as CPA ones, the opportunities are still good. CA jobs are more likely to be with foreign firms specializing in business. These firms can be found anywhere in the world, including the United States. Those who want to work with multinational companies should seek out the job prospects in their preferred country. Accounting professionals' job prospects are influenced by the health of the economy.

Education necessary

If you want to be an accountant, you should get your degree. There are several types of accounting degree programs, including graduate studies and post-graduate training. Many accountants choose to become Certified Public Accountants. This certification increases your earning power as well as job opportunities. The education required to become an accountant varies depending on where you go and what program you choose. You may also want to earn a master's to be more competitive on the job market.

An accountant should hold a bachelor's degree, and be a CPA. Most accountants work in corporate settings, but many also work for government agencies, insurance companies, and enterprise businesses. Some accountants also work for their own companies. According to the Bureau of Labor Statistics(BLS), the number of accountants is expected to grow by 7% in 2020-2030. You can also become a self-employed accountant to help you get started in this field.

Salary

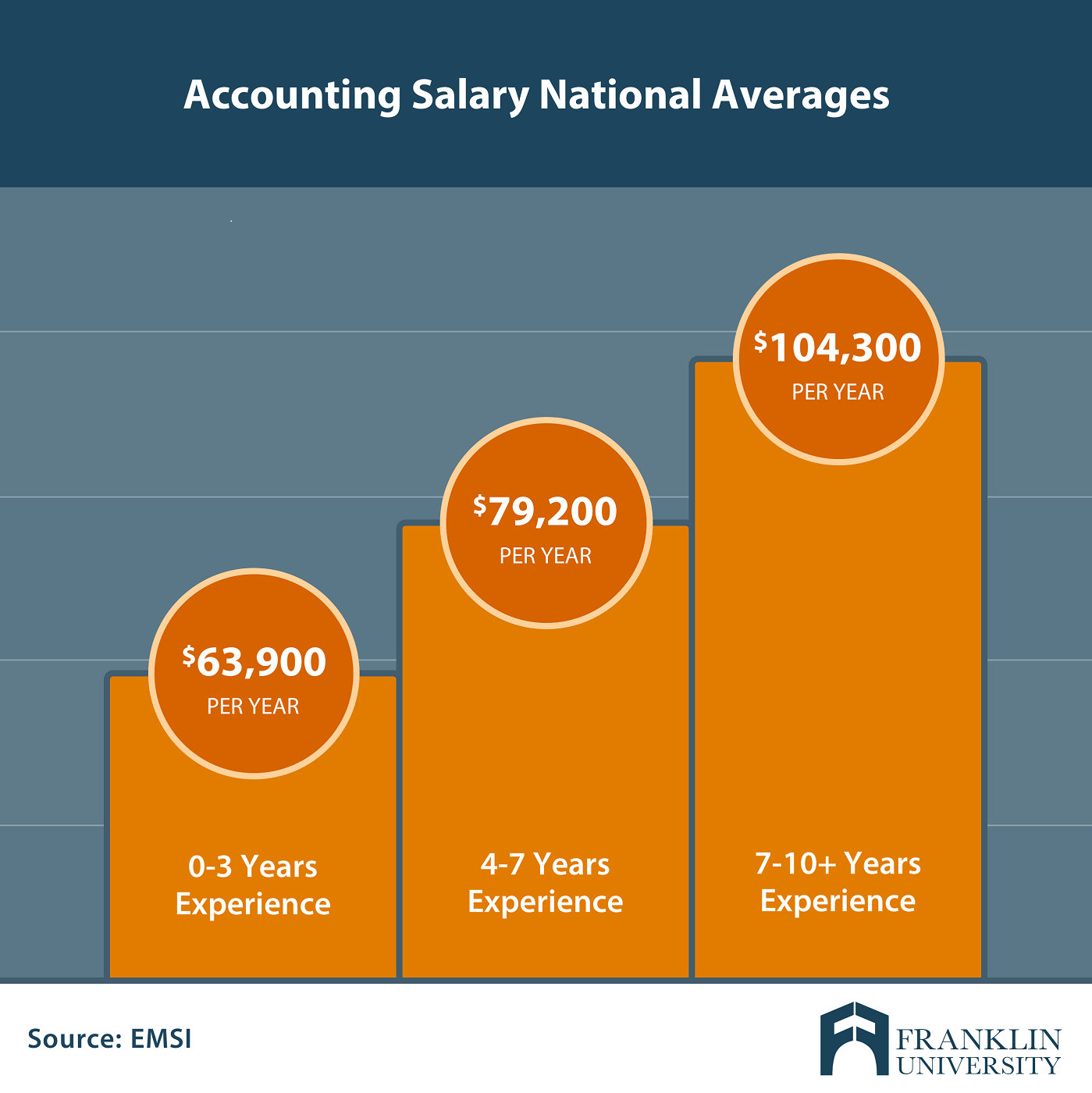

In the United States, the salary of accountants is highly dependent on the location they work. It is important to consider whether a particular region is in high demand or expensive for accountants. According to the Robert Half Salary guide, New York accountants multiply their national income by 141 percent to get a local wage at $71,500. El Paso accountants get a job for about 70% less.

The Bureau of Labor Statistics, (BLS), has data on the growth of job opportunities and salaries. Data on job growth are available at both the state and national levels. They do not consider specific circumstances in schools. You should also note that data on salary and job gains in one state may not represent those in another. Before you choose a career, make sure to check out the data on job growth and salary ranges for your region.

FAQ

What is the difference between accounting and bookkeeping?

Accounting is the study of financial transactions. Bookkeeping is the recording of those transactions.

These two activities are closely related, but distinct.

Accounting is primarily about numbers while bookkeeping is primarily about people.

To report on an organization's financial situation, bookkeepers will keep financial information.

They adjust entries in accounts payable, receivable, and payroll to ensure that all books are balanced.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

They may suggest changes to GAAP if they do not agree.

Bookkeepers keep records of financial transactions so that the data can be analyzed by accountants.

What is the value of accounting and bookkeeping

For any business, bookkeeping and accounting are crucial. They enable you to keep track all of your expenses and transactions.

These items will also ensure that you don't spend too much on unnecessary items.

It is important to know the profit margin from each sale. Also, you will need to know how much debt you owe other people.

You might consider raising your prices if you don't have the money to pay for them. However, if your prices are too high, customers might not be happy.

If you have more than you can use, you may want to sell off some of your inventory.

You could reduce your spending if you have more than you need.

All these things will have an impact on your bottom-line.

What is bookkeeping?

Bookkeeping is the art of keeping records of financial transactions for individuals, businesses, and organizations. This includes all income and expenses related to business.

Bookkeepers maintain financial records such as receipts. They also prepare tax returns and other reports.

What are the signs that my company needs an accountant?

When a company reaches a certain size, accountants are often hired. For example, a company needs one when it has $10 million in annual sales or more.

However, some companies hire accountants regardless of their size. These include small companies, sole proprietorships as well partnerships and corporations.

A company's size doesn't matter. It doesn't matter how big a company is.

If it does then the company requires an accountant. A different scenario is not possible.

What is the difference between a CPA and a Chartered Accountant?

A chartered accountant is a professional accountant who has passed the exams required to obtain the designation. Chartered accountants have more experience than CPAs.

Chartered accountants can also offer advice on tax matters.

To complete a chartered accountant course, it takes about 6 years.

What happens if I don't reconcile my bank statement?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

At this point, you will need repeat the entire process.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

Accounting for Small Business

Accounting for small businesses can be a crucial part of any business's management. Accounting involves keeping track of income, expenses, creating financial reports and paying taxes. You may also need to use software programs like Quickbooks Online. There are many different ways you can do your small business accounting. You have to decide which method is best for you based on your specific needs. Here are some top options that you can consider.

-

Use paper accounting. Paper accounting is a good option if you prefer simplicity. The process of using this method is very easy; you just need to record your transactions daily. A QuickBooks Online accounting program is a good option if your records need to be complete and accurate.

-

Online accounting. Online accounting gives you the ability to easily access your accounts whenever and wherever you are. Wave Systems and Freshbooks are three of the most widely used options. These software are great for managing your finances, sending invoices and paying bills. They offer great features and benefits, and they are easy to use. These programs are great for saving time and money in accounting.

-

Use cloud accounting. Cloud accounting is another option that you could use. It allows you to store your data securely on a remote server. Cloud accounting is a better option than traditional accounting systems. First, it does not require you to buy expensive hardware or software. You have better security since all your information can be accessed remotely. It saves you the hassle of backing up your data. It makes it easy to share files with others.

-

Use bookkeeping software. Bookkeeping software can be used in the same manner as cloud accounting. But, it is necessary to purchase a new computer and install it. After the software has been installed, you can connect to your internet account to access them whenever you like. In addition, you will be able to view your accounts and balance sheets directly through your PC.

-

Use spreadsheets. Spreadsheets allow you to enter your financial transactions manually. A spreadsheet can be used to record sales figures for each day. You can also make changes whenever you like without needing to update the whole document.

-

Use a cash book. A cashbook is a ledger where you write down every transaction that you perform. There are many different shapes and sizes of cashbooks depending on how much room you have. You can either keep separate notebooks for each month or one that spans several months.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. To help you remember what was bought, you can make notes once you have scanned the items.

-

Use a journal. A journal is a type logbook that tracks your expenses. This is especially useful if you have frequent recurring expenses such rent, utilities, and insurance.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it for tracking your spending habits or planning your budget.