You've heard about Accounting Information Systems (AIS) and wondered what it entails. The following article will provide an overview of the job and discuss the education requirements. It also discusses the career outlook. In the next section, you will find information on certifications necessary for this profession. Specialized knowledge in accounting and information system is necessary to succeed. Furthermore, you need to be able and competent in creating accurate, reliable, efficient, and cost-effective accounting information systems.

Doing job

Accounting information systems careers are varied and include many responsibilities. Aside from overseeing the implementation of new systems, they also analyze user information needs and make recommendations. They work closely alongside the IT department and accounting to integrate commercial accounting software within an organization's system. They are the link between IT and accounting departments. They are responsible for accounting functions in smaller organizations. They are responsible for all aspects of the organization, including accounting and IT.

Education required

A number of core subjects are included in the undergraduate accounting and information technology programs, including database theory, business law and web programming. Students who complete an AIS degree gain skills in problem-solving and critical thinking as well as ethical reasoning. Computer science professors with real-world experience are available to students. In addition, students take courses that focus on the business environment and the role of information systems in accounting and management.

Career outlook

As technology improves, the demand for accounting information systems jobs is increasing. The computerized system is used to process accounting numbers. They are responsible for analyzing economic data and performing audits. Information technology, unlike traditional accounting, is increasingly being used in daily business operations. This means that there are many opportunities for both IT and accounting specialists to grow their careers. Below is a list of some of the most important accounting information system jobs as well as the degree required for them.

Certifications

The accounting profession has developed from the simple job of tax preparation and bookkeeping to the complex science of accounting information systems. These professionals specialize in technological and financial issues, and they hold various roles in large organizations. Different certifications may be held by accounting information systems professionals. These include those for auditors or certified public accountants. They all share one thing: they keep track of the company's finances.

Salary

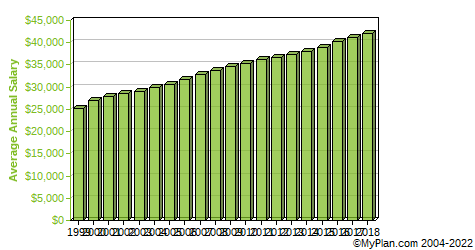

Accounting Information Systems is a job that pays $53,822. The average annual salary for an Accounting Information Systems job is $53,822. The salaries for Accounting Information Systems professionals in the United States can range from $10,389 to $277,666 annually. The median salary is $49,000. The top 10% earn more that $130,000. Accounting Information Systems salary can vary depending upon experience and geographic location.

FAQ

What is bookkeeping?

Bookkeeping is the art of keeping records of financial transactions for individuals, businesses, and organizations. This includes all income and expenses related to business.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns and other reports.

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He validates the accuracy of figures provided by companies.

He also checks the validity of financial statements.

What are the signs that my company needs an accountant?

Many companies hire accountants after reaching certain levels. For example, a company needs one when it has $10 million in annual sales or more.

However, not all companies need accountants. These include sole proprietorships, partnerships and corporations.

A company's size doesn't matter. Only what matters is whether or not the company uses accounting software.

If it does then the company requires an accountant. It doesn't if it doesn't.

What is accounting's purpose?

Accounting gives an overview of financial performance. It measures, records, analyzes, analyses, and reports transactions between parties. It allows companies to make informed decisions about their financial position, such as how much capital they have, what income they expect to generate from operations, or whether they need additional capital.

To provide information on financial activities, accountants record transactions.

The organization can use the data to plan its future budget and business strategy.

It is important that the data you provide be accurate and reliable.

What is an accountant and why are they so important?

An accountant keeps track and records all the money you spend and earn. An accountant also records how much tax you have to pay and the deductions that are allowed.

An accountant will help you manage your finances, keeping track of both your incomes as well as your expenses.

They prepare financial reports for individuals and businesses.

Accountants are needed because they have to know everything about the numbers.

Accountants also assist people with filing taxes to ensure that they are paying as little tax possible.

What is the significance of bookkeeping and accounting

Accounting and bookkeeping are essential for every business. They allow you to keep track of all transactions and expenses.

They also help you ensure you're not spending too much money on unnecessary items.

You should know how much profit your sales have brought in. You'll also need to know what you owe people.

You may want to raise prices if there isn't enough money coming in. However, if your prices are too high, customers might not be happy.

You might consider selling off inventory that is larger than you actually need.

You could reduce your spending if you have more than you need.

All these things will affect your bottom line.

Statistics

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

External Links

How To

How to do Bookkeeping

There are many types of accounting software available today. While some are free and others cost money, most accounting software offers basic features like invoicing, billing inventory management, payroll processing and point-of-sale. The following is a brief overview of the most widely used types of accounting software.

Free Accounting Software: This software is typically free for personal use. It may have limited functionality (for example, you cannot create your own reports), but it is often very easy to learn how to use. Many free programs also allow you to download data directly into spreadsheets, making them useful if you want to analyze your business's numbers yourself.

Paid Accounting Software is for businesses with multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. Many companies offer subscriptions with a shorter duration than six months, but most paid programs require a minimum subscription of at least one year.

Cloud Accounting Software: You can access your files from anywhere online using cloud accounting software. This program has been growing in popularity because it reduces clutter and saves space on your computer's hard drive. You don't even have to install any extra software. All that is required to access cloud storage services is an Internet connection.

Desktop Accounting Software: Desktop accounting software is similar to cloud accounting software, except that it runs locally on your computer. Desktop software is similar to cloud software. You can access your files from anywhere you want, even through mobile devices. However, unlike cloud-based software, desktop software must be installed on your computer before it can be used.

Mobile Accounting Software - Mobile accounting software is specially designed for small devices such as smartphones and tablets. These apps allow you to manage your finances on the move. They have fewer functions that full-fledged desktop apps, but they're still extremely useful for people who travel often or run errands.

Online Accounting Software: Online accounting software is designed primarily for small businesses. It has all the features of a traditional desktop software package, but with a few additional bells and whistles. Online software has one advantage: it doesn't require installation. Simply log on to the site and begin using the program. You'll also save money by not having to pay for local office costs.