A controller is a job that could be a great fit for someone who wants to work in finance. Many people have been enamored by this job role, but if you have no idea how to start, this article will provide you with the information you need to make the right move. You can make a successful career in finance by following these guidelines. Be aware that this role comes with a lot of responsibility.

The role of controller was once a simple pea-counter. But today, it is considered a management partner. This person is involved in strategic planning, assists with the implementation of management goals, and advises management about corrective action. A controller recognizes opportunities for development, synergies, and savings. A controller is a person who prioritizes profitability and uses tools to support planning. It is a demanding position that requires an aggressive attitude and analytical skills as well as the ability to work on your own.

Most positions for controllers require at least seven years of relevant experience. Typically, these professionals have either a bachelor's or an MBA, but many employers look for additional qualifications and certifications. Most employers are looking for controllers with at least five years' experience in accounting and finance. Many controllers begin their careers in cost accounting and progress to management roles. Others work first as assistant controllers in order to gain experience and prove their capabilities.

While the job description of a controller may be different at smaller companies, there are some common traits. People who are organized and have great skills will do well in this job. They will also be appreciated. These attributes are not enough. Financial controllers also need to be confident, knowledgeable, and able to take responsibility. This job is safe and well-paid.

The most important thing for controllers is to get a bachelor's level in accounting or finance. A MBA can help you improve your career prospects. More companies are looking for controllers who have advanced degrees. The master's program will teach you how to use accounting programs and financial analysis. After a year of experience in an accounting firm, or another business, you may be eligible to apply for a controller job.

This job requires a degree but not all jobs require extensive experience. Good controllers have a natural talent for numbers and an eye for large financial trends. While an MBA is typically required, employers prefer applicants with at least five year's work experience. A controller must have a bachelor's degree and a track record in management.

A controller must be able to think critically and have a good understanding of algebra. Aside from these skills, you will need excellent interpersonal skills. As a controller you will have to interact with many people and work closely in collaboration with the management team. You will need to be able handle multiple projects simultaneously and work within deadlines. It will be much easier to find a job within an organization after you become a controller.

FAQ

What's the difference between a CPA or Chartered Accountant?

Chartered accountants are accountants who have passed all the necessary exams to get the designation. Chartered accountants are typically more experienced than CPAs.

Chartered accountants are also qualified to offer tax advice.

The average time to complete a chartered accountancy program is 6-8 years.

What is the purpose and function of accounting?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. It allows companies to make informed decisions about their financial position, such as how much capital they have, what income they expect to generate from operations, or whether they need additional capital.

Accounting professionals record transactions to provide financial information.

The organization can use the collected data to plan its future strategy and budget.

It is crucial that the data are accurate and reliable.

What is an audit?

An audit is a review or examination of financial statements. An auditor examines the company's accounts to ensure that everything is correct.

Auditors look for discrepancies between what was reported and what actually happened.

They also examine whether financial statements for the company have been properly prepared.

What's the significance of bookkeeping & accounting?

Accounting and bookkeeping are essential for every business. They help you keep track of all your transactions and expenses.

These items will also ensure that you don't spend too much on unnecessary items.

Know how much profit you have made on each sale. You will also need to know who you owe.

If you don't have enough money coming in, then you might want to try raising prices. However, if your prices are too high, customers might not be happy.

You may be able to sell some inventory if you have more than what you need.

You can reduce the number of products or services you use if you have less money.

All these things will have an impact on your bottom-line.

What is the average time it takes to become an accountant

Passing the CPA exam is required to become an accountant. Most people who are interested in becoming accountants have studied for at least 4 years before taking the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

What is the best way to keep books?

You'll need to have a few basic items in order to start keeping books. These are a notebook with a pencil, calculator, printer and stapler.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

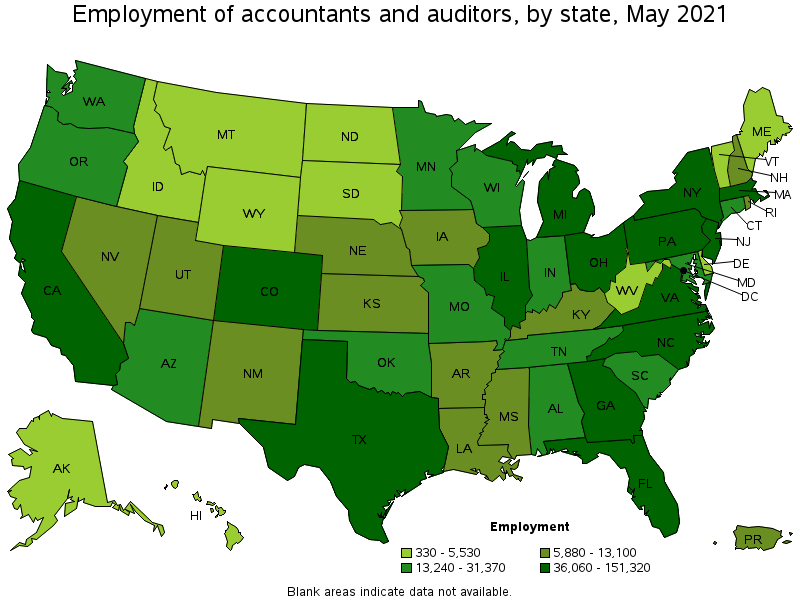

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to Become a Accountant

Accounting is the science that records transactions and analyzes financial data. Accounting can also include the preparation of reports or statements for various purposes.

A Certified Public Accountant or CPA is someone who has passed an exam and received a license from the state board.

An Accredited financial analyst (AFA), or an individual who meets the requirements of the American Association of Individual Investors, is an individual who is accredited by Financial Analysts. A minimum of five years' experience in investment is required by the AAII before an individual can become an AFA. They must pass several examinations to prove their understanding of securities analysis.

A Chartered Professional Accountant (CPA), also known as a chartered accounting, is a professional accountant with a degree from a recognized university. CPAs must meet specific educational standards established by the Institute of Chartered Accountants of England & Wales (ICAEW).

A Certified Management Accountant (CMA), is a certified professional accountant that specializes in management accounting. CMAs must pass the ICAEW exams and continue their education throughout their careers.

A Certified General Accountant is a member of American Institute of Certified Public Accountants. CGAs must pass multiple exams. One of these tests, the Uniform Certification Examination or (UCE), is required.

International Society of Cost Estimators, (ISCES), offers the Certified Information Systems Auditor (CIA), a certification. Candidates for the CIA certification must complete three levels, which include coursework, practical training and a final assessment.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs must have a baccalaureate in finance, business administration or public policy. They also need to pass two written and one oral exams.

The National Association of State Boards of Accountancy offers the certification of Certified Fraud Examiners (CFE). Candidates must pass at least three exams to be certified fraud examiners (CFE).

A Certified Internal Auditor (CIA) is accredited by the International Federation of Accountants (IFAC). Four exams must be passed by candidates to receive certification as an Internal Auditor (CIA). They will need to pass topics like auditing, compliance, risk assessment and fraud prevention.

American Academy of Forensic Sciences (AAFS) designates an Associate in Forensic Account (AFE). AFEs should have a bachelor's degree from an accredited college, university or other educational institution in any area of study.

What does an auditor do? Auditors are professionals who inspect financial reporting controls and audit the internal controls. Audits may be conducted on a random basis, or based in part on complaints made by regulators.