A bachelor's degree is 120 semester hours. Students can also complete a certificate program post-baccalaureate to get the 30 additional credits required for the Kansas CPA exam. You can find many online programs. The most popular way to get the extra credits for the exam is to enroll in a five year CPA track program. This program combines the bachelor's curriculum and a master's degree. It gives you 150 semester hours to pass the Kansas CPA exam. You must earn your degree from an accredited institution in order to be certified as a Kansas CPA.

Kansas CPA Exam

If you feel that you are competent enough to pass the Kansas CPA exam, you can apply for it before you graduate. But even if you have a good foundation in accounting, you must meet the experience requirements in order to qualify for the exam. After you finish your studies, you must pass a professional ethics course offered by the AICPA and send the results directly to the KSBOA. The final step is to pay $25 and sign an Oath before scheduling your Kansas CPA Exam.

You should learn the Kansas CPA laws before you apply to take the Kansas CPA exam. This will allow you to properly prepare for the exam. Before scheduling the exam, you will need to have your Section ID from the NTS, birth date, and CPA license requirements. These details are available on the Kansas Board of Accountancy’s website. Once you have all the information you need, you are ready to apply for this exam.

Experience requirements for the cpa Kansas

Kansas has its own experience requirements for CPAs. Before a candidate can sit for the CPA exam in Kansas, he or she must have at least one year of experience in accounting, auditing, taxation, or advisory services. Part-time and full-time experience are acceptable. Candidates must be able demonstrate their skills to the CPA board. In addition to experience requirements, the state of Kansas also requires that CPAs obtain 80 hours of continuing professional education (CPE) each year in order to renew their licenses. CPE credits can be earned through the National Registry of Sponsors.

To become a CPA in Kansas, aspiring candidates must have a place of business or permanent employment in a public accounting firm in the state. In addition, they must have at most 2,000 hours of experience as a professional accountant in the past three years. Experientiales can also be counted if they have experience in government, academia, or industry. Internship hours are not eligible for the CPA experience requirements. Finally, candidates must complete a pre-evaluation application.

Course requirements

CPE (continuing professional education) is one of the requirements to become a Kansas CPA. CPAs must continue education to keep their skills and knowledge current. CPE hours can be a critical part of keeping up to date with changes in the accounting industry. Although there are many options for candidates to fulfill these requirements, most require at least twenty hours of CPE across a variety of subjects.

Kansas's CPA exam requires you to have a bachelor's degree. Most colleges award baccalaureate degrees after 120 hours of study, but students who want to sit for the exam after graduation must complete an additional 30 hours of coursework. You must complete at least 42 credits in business courses to earn these additional 30 hours. Candidates who wish to pursue a career accounting should be capable of meeting these requirements.

CPE requirements

Kansas has a lot of CPE requirements for CPAs. CPE for CPAs is generally 80 hours. CPE credits earned in excess or overtime are carried over to next reporting cycle. Kansas does not require CPAs to be certified in any specific subject. Read on to learn more. These are the Kansas CPAs' primary recertification requirements:

Kansas CPE requirements require that an individual be a Kansas resident, have their business place in the state and be employed as a permanent employee at a public accounting firm. The Kansas CPA Board can waive six hours of education requirements in certain circumstances. However, this is only possible if the individual has completed the 150-hour educational requirement. Candidates must ensure they meet all requirements before waivers can be granted.

FAQ

What is the difference in accounting and bookkeeping?

Accounting studies financial transactions. Bookkeeping is the recording of those transactions.

The two are related but separate activities.

Accounting is primarily about numbers while bookkeeping is primarily about people.

Bookkeepers record financial information for purposes of reporting on the financial condition of an organization.

They ensure all books balance by correcting entries in accounts payable and accounts receivable.

Accountants review financial statements to determine compliance with generally accepted Accounting Principles (GAAP).

They might recommend changes to GAAP, if not.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

What does it mean to reconcile accounts?

A reconciliation is the comparison of two sets. The source set is called the “source,” while the reconciled set is called both.

Source consists of actual figures. The reconciled is the figure that should have been used.

If you are owed $100 by someone, but receive $50 in return, you can reconcile it by subtracting $50 off $100.

This ensures that the accounting system is error-free.

What are the signs that my company needs an accountant?

Companies often hire accountants once they reach certain sizes. One example is a company that has annual sales of $10 million or more.

Many companies employ accountants regardless of size. These include small firms, sole proprietorships, partnerships, and corporations.

A company's size doesn't matter. Only important is the use of accounting systems.

If it does then the company requires an accountant. It doesn't if it doesn't.

What are the benefits of accounting and bookkeeping?

For any business, bookkeeping and accounting are crucial. They allow you to keep track of all transactions and expenses.

They also make it easier to save money on unnecessary purchases.

You need to know how much profit you've made from each sale. It's also necessary to know your responsibilities to others.

You may want to raise prices if there isn't enough money coming in. Customers might be turned off if prices are raised too high.

You might consider selling off inventory that is larger than you actually need.

If you have less than you need, you could cut back on certain services or products.

All these factors can impact your bottom line.

What is bookkeeping?

Bookkeeping can be described as the keeping of records about financial transactions for individuals, businesses and organizations. It involves recording all business-related income as well as expenses.

Bookkeepers track all financial information such as receipts, invoices, bills, payments, deposits, interest earned on investments, etc. They also prepare tax returns and other reports.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

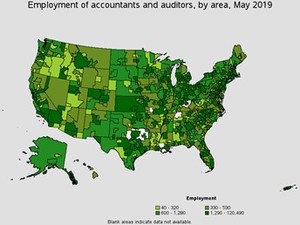

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

Accounting: The Best Way

Accounting is a collection of processes and procedures that businesses use to record and track transactions. Accounting involves recording income and expense, keeping track sales revenue and expenditures and preparing financial statements.

It also involves reporting financial data to stakeholders such shareholders, lenders investors customers, investors and others.

There are many ways to do accounting. Some include:

-

Create spreadsheets manually

-

Excel software.

-

Notes for handwriting on paper

-

Computerized accounting systems.

-

Online accounting services.

There are many ways to do accounting. Each method comes with its own set of advantages and disadvantages. The choice of which one to use depends on your business model. Before you decide on any one method, consider all the pros and disadvantages.

In addition to being efficient, there are other reasons you may decide to use accounting methods. For example, if you are self-employed, you might want to keep good books because they provide evidence of your work. Simple accounting may be best for small businesses that don't have a lot of money. If your business is large and generates large amounts cash, it might be a good idea to use more complex accounting methods.